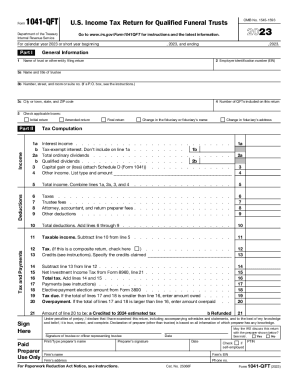

IRS 1041-QFT 2024-2025 free printable template

Show details

Form1041QFTU.S. Income Tax Return for Qualified Funeral Trusts OMB No. 15451593(Rev. December 2024) Department of the Treasury Internal Revenue ServiceGo to www.irs.gov/Form1041QFT for instructions

pdfFiller is not affiliated with IRS

Understanding and Utilizing IRS 1041-QFT

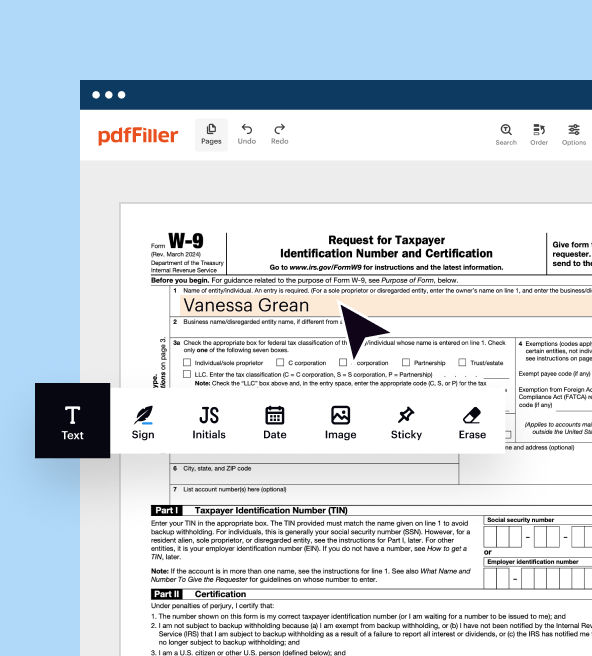

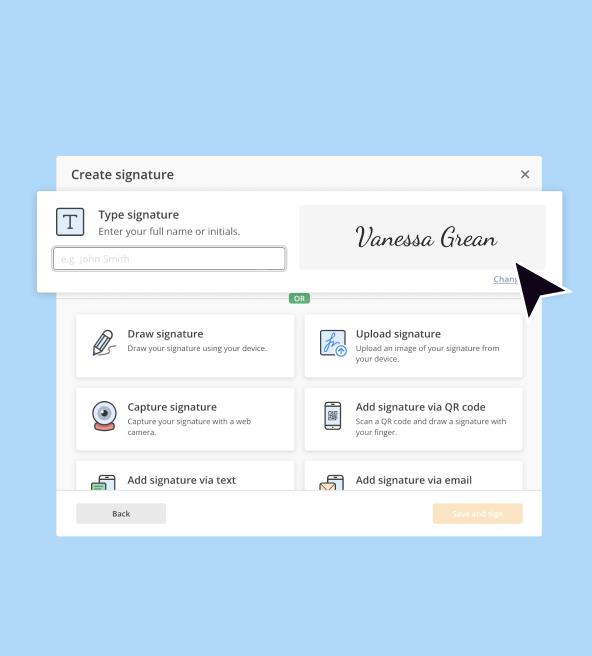

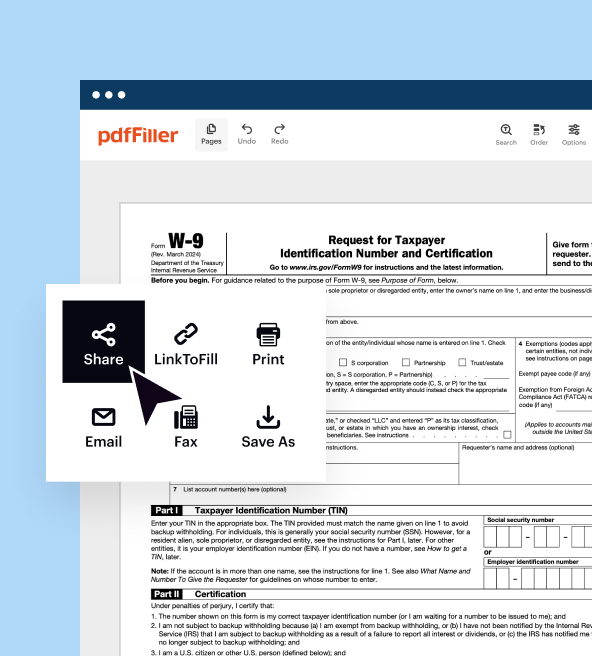

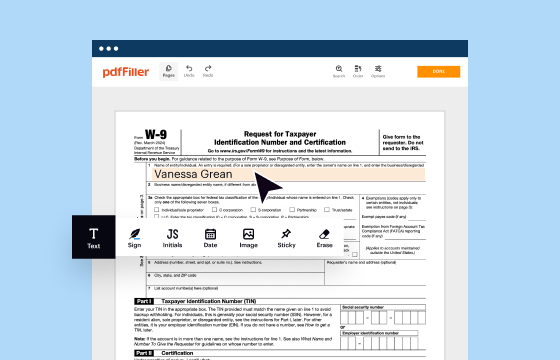

Comprehensive Guide to Editing IRS 1041-QFT

Steps for Completing IRS 1041-QFT

Understanding and Utilizing IRS 1041-QFT

The IRS 1041-QFT form, designed for the income tax return of a qualified funeral trust, is an essential document for those managing funeral trusts. This guide provides clarity on its application, requirements, and recent updates to help you navigate the tax obligations associated with these trusts effectively.

Comprehensive Guide to Editing IRS 1041-QFT

01

Review your trust agreement to ensure all information is accurate and up-to-date.

02

Confirm that the beneficiary information matches your estate plans.

03

Edit any relevant financial year data to reflect current tax standards.

04

Ensure that all income and deductions reported correspond with your financial records and statements.

Steps for Completing IRS 1041-QFT

01

Begin by downloading the IRS 1041-QFT form from the IRS website.

02

Provide your trust’s name and address accurately at the top of the form.

03

Fill in the employer identification number (EIN) associated with the trust.

04

Report all income generated by the trust during the tax year, including interest and dividends.

05

Calculate deductions and credits to reduce your taxable income.

06

Complete the signature section once the form is finalized.

Show more

Show less

What’s New: Recent Changes and Updates to IRS 1041-QFT

What’s New: Recent Changes and Updates to IRS 1041-QFT

Recent updates to the IRS 1041-QFT form have introduced important changes. The IRS has increased reporting thresholds, necessitating more detailed disclosures for certain income types. Additionally, changes have been made to deduction eligibility, thereby influencing tax calculations for many filers. Familiarizing yourself with these alterations is crucial for compliance and effective tax planning.

Essential Insights About IRS 1041-QFT

What is the IRS 1041-QFT?

What Purpose Does IRS 1041-QFT Serve?

Who is Required to File IRS 1041-QFT?

Exemptions Applicable to IRS 1041-QFT Filing

Key Components of IRS 1041-QFT

Filing Deadlines for IRS 1041-QFT

Comparing IRS 1041-QFT with Similar Forms

Transactions Covered by the IRS 1041-QFT

Copies Required for Submission of IRS 1041-QFT

Penalties for Failing to Submit IRS 1041-QFT

Information Required for Filing IRS 1041-QFT

Other Forms Accompanying IRS 1041-QFT

Submission Address for IRS 1041-QFT

Essential Insights About IRS 1041-QFT

What is the IRS 1041-QFT?

The IRS 1041-QFT is specifically designed for funeral trusts, allowing them to report income generated through investments. This form allows trusts to avoid certain taxation situations while facilitating proper fund management for pre-planned funeral expenses.

What Purpose Does IRS 1041-QFT Serve?

This form serves multiple purposes: it informs the IRS about the trust’s income and expenses, ensures compliance with federal tax obligations, and facilitates the management of funds allocated for funeral services. The accurate completion of this form ensures that the trust is operating within legal parameters.

Who is Required to File IRS 1041-QFT?

Generally, any funeral trust that meets IRS qualifications must file this form. This includes trusts funded by individuals for pre-need funeral arrangements where the accumulated funds are expected to generate income. It is imperative for trustees to understand whether their trust structure falls under the IRS regulations governing QFTs.

Exemptions Applicable to IRS 1041-QFT Filing

01

Trusts with income below $600 for the tax year may not be required to file.

02

Trusts established only to cover specific funeral expenses might qualify for exemptions.

03

Certain irrevocable life insurance trusts can also exclude reporting if income is below thresholds.

Key Components of IRS 1041-QFT

The main components of the 1041-QFT include details about trust income, deduction categories, and beneficiary information. Specifically, it requires an accurate accounting of all trust income sources, along with an outline of any distributions made to beneficiaries during the filing year.

Filing Deadlines for IRS 1041-QFT

The typical deadline for filing IRS 1041-QFT is the 15th day of the fourth month following the end of the trust's tax year. For trusts operating on a calendar year, this means the form is due on April 15. Failure to meet this deadline can result in penalties or interest on unpaid taxes.

Comparing IRS 1041-QFT with Similar Forms

Unlike IRS Form 1041, which is for estates and trusts, IRS 1041-QFT is tailored specifically for qualified funeral trusts. This distinction is crucial, as the tax treatments and reporting requirements can vary significantly between these forms. Ensure you choose the correct form based on your trust's structure and purpose.

Transactions Covered by the IRS 1041-QFT

This form covers a range of transactions including funding contributions made to the funeral trust, income generated from investments, and distributions to beneficiaries for covered funeral expenses. Each transaction must be accurately documented to maintain compliance and provide a clear financial picture.

Copies Required for Submission of IRS 1041-QFT

Generally, it is necessary to submit one copy of IRS 1041-QFT to the IRS. Additional copies may be required for state filings or depending on the type of trust and its administrators. Always confirm your specific requirements based on your trust’s situation.

Penalties for Failing to Submit IRS 1041-QFT

01

Late submissions can incur penalties starting at $205 per month, per creditor, for up to 12 months.

02

Failure to file can lead to increased scrutiny from the IRS, potential audits, or legal repercussions.

03

Severe infractions may result in a trust being classified as invalid by the IRS, impacting its tax-exempt status.

Information Required for Filing IRS 1041-QFT

To complete the IRS 1041-QFT, information necessary includes the trust's name, address, EIN, income details, and information about distributions made to beneficiaries. Accurate record-keeping is critical to ensure that all required details are available and validated.

Other Forms Accompanying IRS 1041-QFT

Depending on your trust’s specific circumstances, you may need to file additional forms such as IRS Form 4562 for depreciation or IRS Form 8825 for rental property activities. Verify any other required forms to ensure complete compliance during the filing process.

Submission Address for IRS 1041-QFT

The IRS 1041-QFT should be submitted to the address specified in the IRS instructions according to your mailing address. Ensure to use the appropriate address to avoid delays in processing your filing.

Considering the complexities surrounding IRS 1041-QFT, it’s advisable to consult a tax professional for personal guidance. By staying informed about the details related to this form, you can ensure proper compliance and effective management of funeral trusts. If you are ready to tackle your tax obligations, check out tools that can simplify your filing process.

Show more

Show less

Try Risk Free

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.