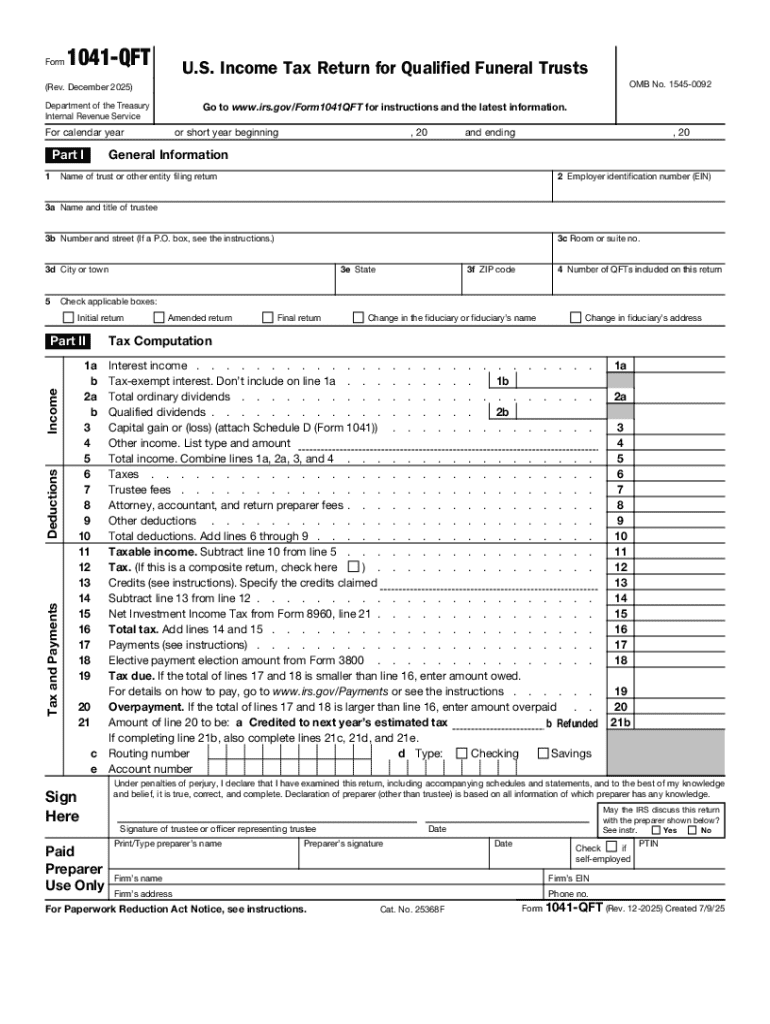

IRS 1041-QFT 2025-2026 free printable template

Instructions and Help about IRS 1041-QFT

How to edit IRS 1041-QFT

How to fill out IRS 1041-QFT

Latest updates to IRS 1041-QFT

All You Need to Know About IRS 1041-QFT

What is IRS 1041-QFT?

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1041-QFT

How can one correct a submitted IRS 1041-QFT if a mistake is identified?

If you discover an error after submitting your IRS 1041-QFT, you can file an amended return to correct it. Use Form 1041-X for this purpose, clearly indicating the corrections made and providing any necessary explanations. Ensure that your amendment is submitted to the same office that processed the original return.

What steps should I take to verify that my IRS 1041-QFT has been received and processed?

To check the status of your IRS 1041-QFT, you can use the IRS 'Where's My Refund?' tool if you expect a refund or contact the IRS directly if you have concerns about your submission. Common e-file rejection codes can also provide insights into potential issues that may need addressing.

Are e-signatures acceptable when filing the IRS 1041-QFT electronically?

Yes, e-signatures are generally accepted for filing the IRS 1041-QFT electronically. However, it's important to ensure that your e-filing system complies with IRS requirements regarding authentication and signature verification to avoid any complications.

If I represent someone else in filing their IRS 1041-QFT, what documentation is needed?

When filing the IRS 1041-QFT on behalf of another individual, you must have a Power of Attorney (POA) form, typically Form 2848. This documentation grants you the authority to act on their behalf, ensuring that the filing process adheres to IRS protocols.

What common errors should be avoided when preparing the IRS 1041-QFT?

Common errors when filing the IRS 1041-QFT include incorrect taxpayer identification numbers, misreporting income, and failing to check the filing instructions thoroughly. Double-checking entries and ensuring all supporting documents are accurate can significantly reduce the chance of mistakes.